Within the framework of IMC plan to support industrial enterprises and increase their competitiveness, Access to Finance and Financial Services Department has been established to offer a set of financial consultancy services to all the industrial enterprises. Those services aim to support and develop industrial beneficiaries through a pool of financial experts inside IMC.

The Department focuses on overcoming financial impediments facing those enterprises, and facilitating ways for their access to finance to maintain their operations competently. It also offers financial training courses and consultation services that help them enhancing their financial departments, which reflects on rationalism of taking investment decisions.

Program goals

- Improve IMC beneficiary companies’ financial performance through offering a series of financial consultancy services and training courses.

- Improve IMC beneficiary companies’ access to finance through facilitating procedures required, resulting in increasing in their investment value, which leads to attracting more investments.

Program services

- Financial Consultation Services

- Financial Training Courses.

- Non Performing Support Program

- Access to Finance Program

Financial Consultation Services

Projects Feasibility Assessment

- Identifying the coordinating and participating team of the beneficiary company

- Studying the current production capacity and the targeted capacity (through the company team)

- Distributing tasks among the work team

- Preparing the financial and economic study based on the marketing, technical and productive study data provided by the beneficiary company.

Budgeting

Developing a budget planning for the beneficiary company via a number of steps as follows:

- Studying and analyzing sales volume and developing sales budgets

- Studying and analyzing production volume and preparing production budget

- Studying and analyzing indirect cost elements and preparing indirect cost budget

- Qualifying the team to prepare budgets.

Financial Analysis

This service includes:

- Assessing the accuracy, efficiency and complementarity of financial statements.

- Analyzing the profitability, efficiency and liquidity of the financial ratios.

- Qualifying the team of beneficiary company on how to read and analyze the financial statements properly (know-how) and how to come into conclusions and results that help the company to improve its financial performance in the future

Designing Cost Control systems

This service includes:

- Analyzing the existing system and set plan for providing the service.

- Visiting the factory to monitor production and manufacturing process starting from receiving the raw material until the end of the production processes and having a finished product ready for sale.

- Delivering the cost control system that allows the beneficiary company to identify fixed and variable costs as well as identifying final cost for each product separately.

- Qualifying the teamwork of the beneficiary company on calculating product cost (know-how).

Designing Accounting systems

This service includes:

- Studying and analyzing the existing Accounting System, and identifying the purpose of the required system.

- Defining the staff of the beneficiary company that will be responsible for preparing, upgrading, sustaining, identifying polices and scope of the new accounting system that is being prepared.

- Clearly identifying the terms’ definitions that will be used in the new accounting system

- Identifying the requirements and long term support needed for the financial department of the beneficiary company, and allocating responsibilities among its staff

- Establishing the appropriate Accounting System for the beneficiary company, which will help provide internal control and accounting standards and service recipients to use the new system

- Qualifying the staff of the beneficiary company on preparing the financial statements (know-how)

Financial Department Needs Assessment

This service includes:

- Studying and analyzing the existing financial systems and to what extent they are suitable for the needs of the beneficiary company

- Assessing the needs of the financial department’s staff for attending financial training courses

- Preparing a report for the needs of the financial department in terms of financial consultancy services and training courses

Financial training courses

Budgeting and feasibility study course

A three days training course targeting the staff of the financial department and other departments’ heads.

Skills acquired by trainees at the end of the training course:

- Identify the process of preparing budgeting and financial planning

- Identify the data required to prepare the budgeting and financial planning, and how to collect it

- Identify the outputs of the budgets planning

- Identify how to study any project economically, using marketing and productivity data

- Qualifying trainees on how to prepare the budgeting and feasibility study

Costing and Pricing course

A three days training course targeting staff of the general management, financial department and production department.

Skills acquired by trainees at the end of the training course:

- Identifying all cost methods

- Cost allocation systems

- Methods of recording products’ costs

- The relationship between cost, volume, and profit (CVP), which include breakeven and sensitivity analysis

- Pricing strategies

- Reading the financial statements from a costing perspective

- Evaluating performance by calculating variances

Financial Analysis course

A two days course targeting staff of financial departments, aiming for qualifying trainees to how to analyze the financial statements.

Skills acquired by trainees at the end of the training course:

- Explanation of the financial statements

- Identify financial statements users inside and outside the enterprise.

- Identify financial statements vertical analysis

- Identify financial statements horizontal analysis

- Identify financial ratios analysis

- Identify The know-how of using the financial ratios in analyzing the financial statements

4- Professional Accountant Course

A three days training course aiming to qualify the staff of the financial department on how to prepare of financial statements.

Skills acquired by trainees at the end of the training course:

- Identify importance of the financial department and its functions

- Identify accounting principles

- Identify financial statements and their importance

- Identify accounts items that may cause problems

- Ability to prepare journal entries

- Ability to prepare ledger (“T” accounts) and trial balance

- Ability to prepare balance sheet and income statement

- Ability to prepare cash flow statement

Financials for non-financials

A three days training course directed to all employees of the beneficiary company except those of the financial department. The aim of the training is to define the company’s employees about the financial department and how it works, as well as giving them an idea about accounting basics to allow them understand different types of financial reports.

Skills acquired by trainees at the end of the training course:

- Ability to identify the differences between finance and accounting

- Ability to identify the different types of companies and their legal forms

- Ability to identify accounting journal entries

- Ability to identify ledger and trial balance

- Ability to identify the accounting principles

- Ability to identify how to prepare and read financial statement

- Ability to identify the different types of financial institutions and an overview of the stock exchange

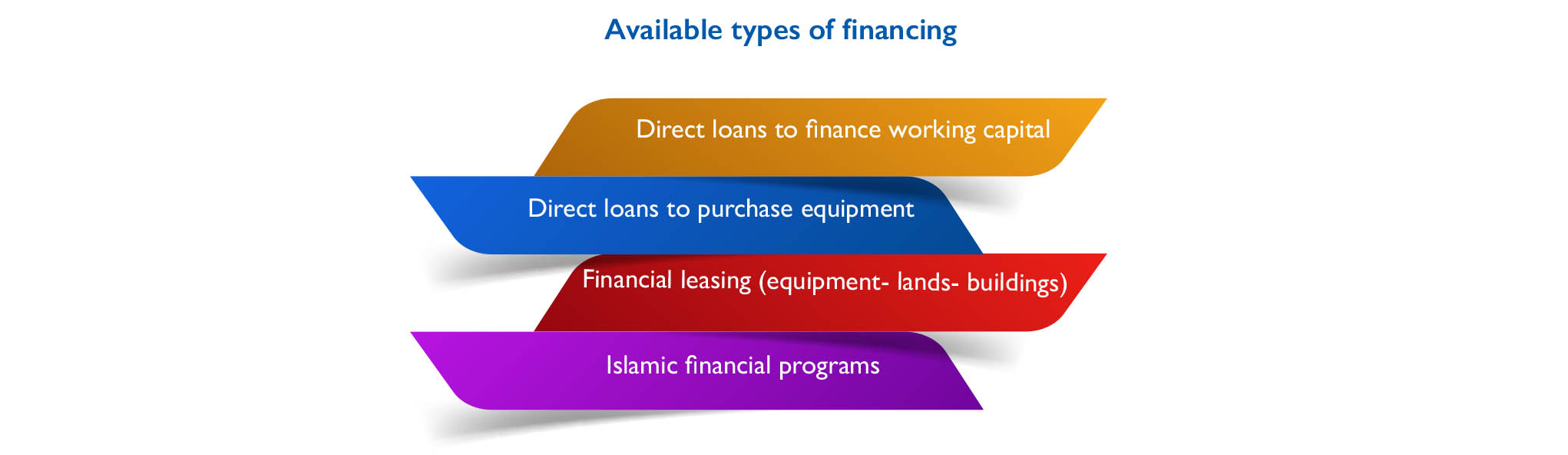

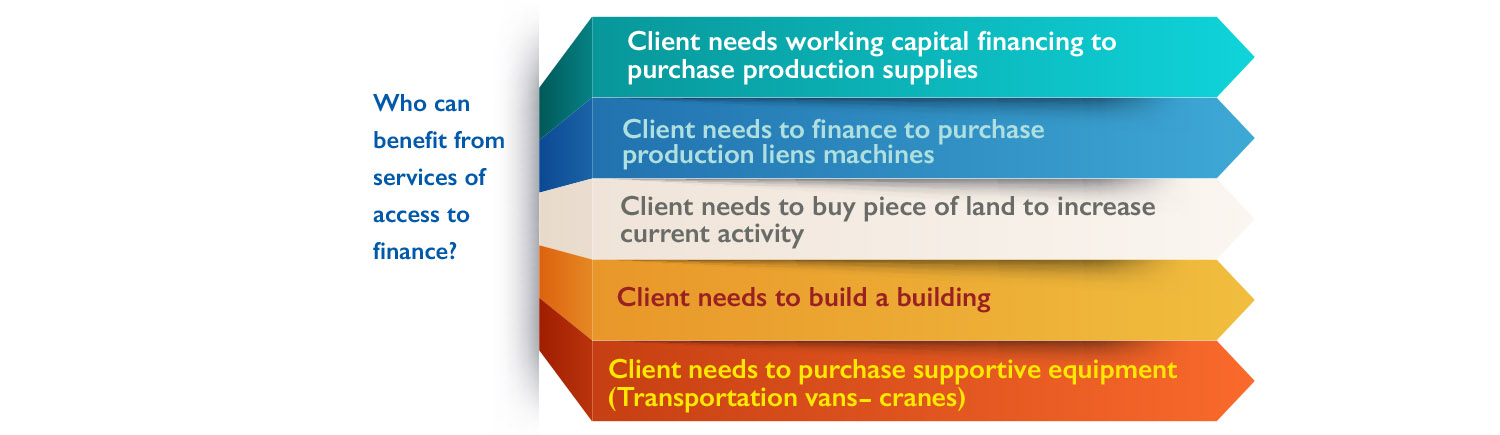

Access to finance

The aim of this service is to maximize the opportunities of access to finance to the IMC beneficiary companies through facilitating financing procedures and approaching different financing tools, this will help in increasing the investment values of those companies and consequently leads to attracting more investments.

This service is provided through the following steps:

Preparing a complete and comprehensive technical and financial file to the beneficiary company as requested by the financing institutions which includes the following:

- Receiving the required documents and papers from the beneficiary company

- Reviewing the marketing and productivity studies that received from the beneficiary company

- Preparing the financial study and business plan

- Defining the available financing opportunities in line with the customer’s circumstances for making preference decision

- The file is submitted in the presence of representative from the beneficiary company to the financing agency agreed upon

- This service is accomplished upon handing over the file to the financing institution and signing the Central Bank's inquiry acknowledgment form